Compliance

Achieve hassle-free freelancer tax compliance. Your clients receive VAT-ready invoices issued by Remotify. Let Remotify manage every layer of VAT-compliant invoicing, so you stay laser-focused on delivering exceptional freelance services.

How it works

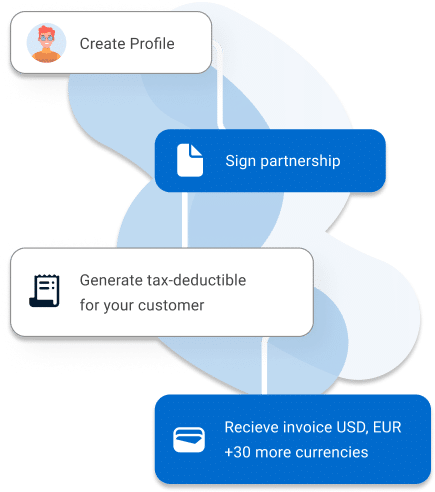

4 Steps for creating an invoice;

Create your account

Activate Your Partnership

Generate the invoice

Receive the payment (in 24 hours)

With Remotify, you can easily create invoices that comply with the legal requirements of over 150 countries worldwide. Our platform simplifies the invoicing process, ensuring that your documentation meets the specific regulations of each country, saving you time and effort.

By creating invoices through Remotify, you can be confident that your invoicing practices remain compliant and legal. Our platform stays up to date with the tax laws, invoicing regulations, and specific requirements of each country, so you don’t have to worry about staying compliant on your own.

When you use Remotify to create invoices, your customers receive professional invoices directly from us. This adds credibility and a sense of professionalism to your freelance business. Clients appreciate receiving invoices from a trusted invoicing platform, enhancing the overall client experience.

Tax compliance can be daunting, especially when dealing with international clients. Remotify simplifies tax compliance by automating tax calculations and ensuring that the necessary tax information is included in your invoices. This helps you to stay compliant with local tax regulations, even in different countries.

Steps

Create your account

Accept

the agreement

Generate the

invoice

Receive the

payment

Reviews

Case Study

Meet Mark, a freelancer who currently lives in Portugal and has been using Remotify to create invoices for his customers.

Case Study

Any question, check below...

Remotify, is a platform that enables you to create invoices and collect payments without having to register a company.

As a partner of Remotify, you become a subcontractor and can use Remotify’s company to invoice your customers. Invoices are created only for digital services and are audited by the platform.

Remotify takes a commission of 5% of the total amount from the billing party. The commission rate varies based on the transaction volume. Please check the pricing page for details.

Yes, those who earn income must declare their income in the country where they reside. We will soon be developing tools to make it easier for you to report your taxes.

You can use Remotify for digital services such as web design, software development, digital marketing, and consultancy.

Registering and running a company can be time-consuming and expensive. With Remotify, you can delegate these tasks to us and focus on growing your business.

Research shows that freelancers spend 25% of their time on administrative tasks. Remotify can save you time and effort by handling these tasks for you.

Your customers can pay via PayPal, SWIFT,, SEPA Bank Transfer,, Apple Pay, and credit cards (EUR).

You can receive payments from all countries except those on the blacklist.

Your customers can pay in USD, EUR, GBP, and TRY for bank accounts. For credit cards, we can only accept EUR.

You can receive your money in USD, GBP, EUR, and TRY.

Generally, it takes one business day, but this depends on your bank account and currency.

Yes, you can follow your payments from the platform.

We have reminder tools that you can use to send reminders to your customers.

Yes, they do.

You can contact us via live chat or email.

No, all fees are included in the commission.