VAT-compliant invoicing for freelancers

Create VAT-compliant, multi-currency invoices with Remotify’s freelancer invoicing platform

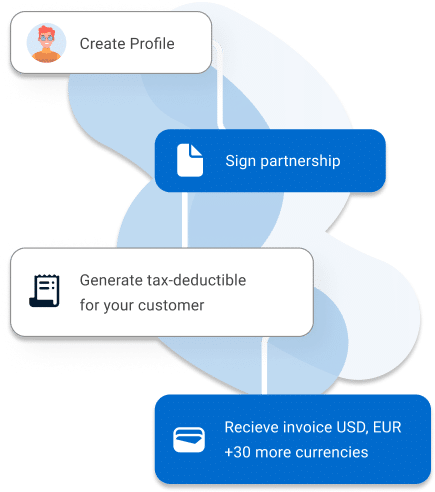

How it works

4 Steps for creating an invoice;

Create your account

Activate Your Partnership

Generate the invoice

Receive the payment (in 24 hours)

At Remotify, we simplify freelancer tax compliance by automating VAT inside our global payment platform for freelancers. VAT is a flat tax levied at every value-add stage, and every EU country sets its own rate—one reason freelancer tax compliance can quickly become complex. As a freelancer, you must calculate VAT for each client and keep every invoice fully VAT compliant—no small task when you work cross-border.

We recognize that managing VAT can be a gigantic headache and a time-consuming process. Our freelancer invoicing platform automates every VAT rule, so you focus on billable work instead of spreadsheets. With Remotify, you streamline VAT through built-in multi-currency invoicing and get back to your core work.

Our intuitive tools create and send VAT-compliant invoices in seconds, powering seamless cross-border freelancer payments. Whether your client holds a valid VAT number or not, our engine adapts rates automatically, keeping every VAT-compliant invoice audit-ready. For instance, if your customer has a valid VAT number for intra-EU transactions, the VAT is marked as 0% due to the reverse-charge mechanism. On the other hand, if your customer is from Estonia or located in an EU country without a valid EU VAT number, the Estonian VAT rate of 20% will be added to the invoice.

Accuracy matters. We verify VAT numbers via VIES, guaranteeing each VAT-compliant invoice meets EU requirements without extra admin. This ensures that your invoicing is in line with the regulations and requirements.

Say goodbye to VAT headaches—let Remotify handle freelancer tax compliance while you grow your business. Join Remotify and let our global payment platform for freelancers simplify every payout and tax step. Experience the ease and convenience of our platform and take control of your financials with confidence.

Ready to streamline payment management? Sign up today and issue VAT-compliant, multi-currency invoices in minutes.

Steps

Create your account

Accept

the agreement

Generate the

invoice

Receive the

payment

Reviews

Real Experiences from Our Users

Remotify

4.7

34 Reviews

Seamless Transactions without any…

Seamless Transactions without any issues. Would recommend to anyone in need.

The best platform to get your invoices

I have used this platform, it gives a lot good experience than a lot of payment providers. I was struggling to get an invoice from abroad, and it didn't deduct a single penny on my first transaction. This is a very good platform

Best payment handling experience

I've been using Remotify to work as a freelance photographer/filmmaker and it has been the best way to handle payments I've experienced. Platform is really easy to use, everything is clear and runs smoothly. My favorite part is definitely customer support, they respond fast, and find solutions to whatever you ask in a very short time, they're kind and understanding, and very helpful very fast. 100% Recommended

Case Study

Meet Mark, a freelancer who currently lives in Portugal and has been using Remotify to create invoices for his customers.

Case Study

Any question, check below...

By partnering with Remotify, you become a subcontractor and gain access to Remotify’s platform to invoice your clients. Invoices are exclusively for digital services and are fully audited by the platform to ensure compliance with legal and tax requirements

You can contact us via live chat or email.